So often we will fall into this feeling of “I don’t even know where to start” when trying to take action, especially when the action is very complex. We also get ourselves caught up trying to find the 100% best course of action. What happens though, is that you end up in a state of analysis paralysis, where finding the information and determining that best course of action prevents you from even moving.

For example, recently I was trying to figure out where to invest some money I had piled up. I got so caught up worrying about what the absolute best assets to purchase were that I sat on the money for three months. Meanwhile, in that time the stock market had a rebound and rose 10%! So in the process of trying to find the best solution, I cost myself a decent chunk of cash!

The 85% Solution

Instead of looking for the 100% solution, I urge you to employ the 85% solution, which states:

“Getting Started is more important than becoming an expert”

This is a concept that I read recently in Ramit Sethi’s book, I Will Teach You to Be Rich (I Will Teach You to be Rich – Ramit Sethi), and it really resonated with me. Essentially what he’s encouraging you to do is to do enough research to determine your direction, then take action. You are never going to find the 100% solution, and even if you could, the opportunity cost of not taking action is rarely worth the time it takes. What’s important is getting enough knowledge to make educated decisions, then to take action, and collect feedback.

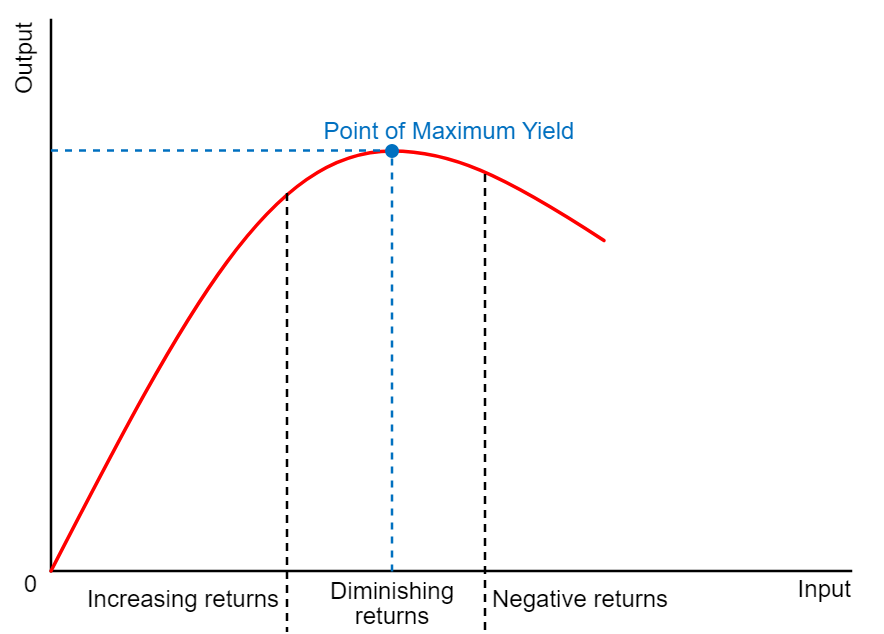

Most things in life follow the law of diminishing returns, where each unit of time and effort gives you less and less return (and in some cases may start to harm you!):

So it’s important to realize when your returns are diminishing, and you need to take action. You will learn so much more from trying and getting feedback than doing more research.

Take Action

Imagine you were heading from New York, U.S. to Lisbon, Portugal. Imagine you sat in the port and tried to rotate your boat perfectly such that once you started your trip you would never have to turn the wheel, and you’d end up in perfectly in Lisbon. What a ridiculous exercise that would be. You could spend weeks or months trying to get it perfect, and that assumes your instrumentation is even accurate enough to find that perfect angle. You could have been across the ocean ages ago if you had just got your direction 85% right, and corrected along the way. And just like the ocean, life will push you off course anyways! So there’s no point in trying to get the 100% solution.

Now let’s bring this into an example in your life. Imagine if you wanted to start running, but you wanted to find the PERFECT (or 100%) running program for you. You could spend months (or even years!) researching, reading, talking to people etc. with no progress to show for! Instead, if you found the 85% solution, running 5km four times a week and got started, you’d be way further ahead (literally). Once you take that action, you can respond to feedback and course correct. Feeling good one day? Up your distance by 1km. Finding you don’t have time to recover between runs? Drop to 3 times per week. You’ll find what works for you to reach your goal.

Incorporate the 85% Solution in Your Life to Take Action

Look for places in your life that you can incorporate an 85% solution. Want to eat healthier? Eat 85% healthy food. Want to invest but don’t know what the best asset allocation for you is? Find one that is 85% right and adjust from there. It’s like riding a bike – getting started is the hardest part. But once you’re moving, keeping moving and correcting your course becomes a lot easier.

If you’re looking for more reading on this principle, I encourage you to check out:

This book has a great example of Unilever mathematicians theorizing a clog-proof nozzle for dishwashing detergent, vs. biologists who took action and course corrected (85% solution) to design the same nozzle. I won’t spoil who’s design works better…

One key place to implement this is your finances. See the following pages to get yourself to the 85% mark in your investing knowledge: